WHAT IS GST?

GST REGISTRATION stands for goods and service tax; it works more or less the same way as VAT that it’s a consumption tax that’s imposed upon the costs of goods and services. In simple ways GST means, it is an indirect tax which has replaced many indirect taxes in India such as; excise duty, VAT, services tax, etc. … In other words, Goods and Service Tax (GST) is levied on the supply of goods and services.

WHAT IS ITS PURPOSE?

The main motive of GST is to reduce the cascading effect of tax on the cost of goods and services and create a common, cooperative and undivided Indian market to make the economy stronger and powerful. So the GST system will combine Central excise duty, additional excise duty, service tax, State VAT entertainment tax, etc.

WHEN GST WAS FIRST PROPOSED?

A single common ‘Goods and Services Tax (GST)’ ;was proposed and given a go-ahead in 1999 during a meeting between the then Prime Minister Atal Bihari Vajpayee and his economic advisory panel, which included three former RBI governors IG Patel, Bimal Jalan and C Rangarajan.

HOW MANY TYPES OF GST ARE PRESENT IN INDIA & WHAT ARE THEY?

- CGST (CENTRAL GOODS &ANDSERVICE TAX);

- SGST (STATE GOODS AND SERVICE TAX);

- IGST (INTEGRATED GOODS AND SERVICE TAX);

- UGST (UNION TERITORY GOODS AND SERVICE TAX).

LET’S ELABORATE THEM:

- CGST (CENTRAL GOODS & SERVICE TAX)

CGST is levied by the central government of India on intra-state goods and services, The CG collects the revenue generated through central goods and service tax. It is levied along with SGST & UGST.

FOR EXAMPLE: if you are a Gujarat based dealer and are selling to another dealer in Gujarat, since it’s an intra state sale, both CGST & SGST are applicable on this transaction. If your transaction of goods worth Rs .100000 and it attracts 18% GST, then 9%, which is 9000 of the amount is collected by State government and matching amount is collected as CGST by the center.

- SGST (STATE GOODS AND SERVICE TAX)

SGST is levied by the state government on intra-state goods and services. The revenue collected through state goods and services is earned by the state government where the transaction is made. SGST subsumes earlier taxes such as VAT, entertainment tax, octroi tax, tax on lottery etc.

In the case of a union territory like Andaman and Nicobar Islands or Chandigarh, SGST is replaced by UGST.

- IGST (INTEGRATED GOODS AND SERVICE TAX)

IGST is levied on inter-state goods and service transitions and is applicable on imports and exports as well.

WHAT IS GST REGISTRATION?

GST REGISTRATION process is online based and must be carried out on the government website gst.gov.in.

Every dealer whose annual turnover exceeds Rs.20 lakhs (Rs.40 lakh or Rs.10 lakhs, as may vary depending upon state and kind of supplies) has to register for GST.

- PART A (GST REG APPLICATION)

- PART B (GST REG APPLICATION)

STEPS TO FILL PART-A OF GST REGISTRATION APPLICATION

- Got to GST PORTAL (gst.gov.in).

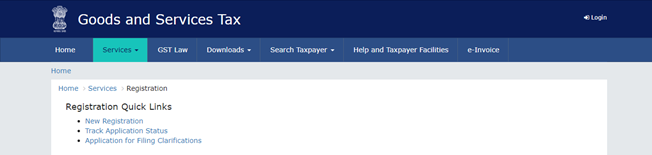

- Click on Services tab.

- Then on New Registration Tab, please fill the details asked.

- Enter the 2 OTP’s received on your mobile and mail id. Click on continue. If you have not received the OTP, please click on RESEND OTP.

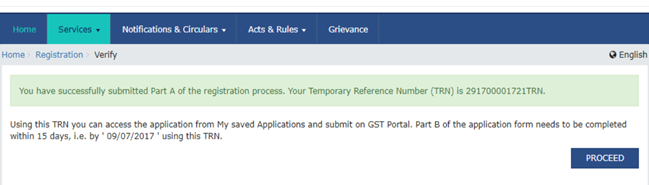

- TRN GENERATED

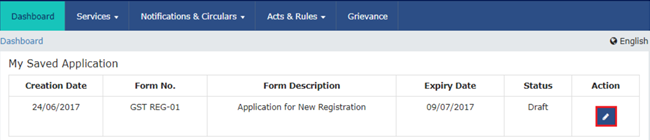

LOGIN WITH THE GENERATED TRN CREDENTIALS

After receiving the TRN, the applicant shall begin the GST registration Procedure, give the generated TRN number in the field TRN number and enter the captcha text as shown on the screen & complete the OTP verification on mail and mobile.

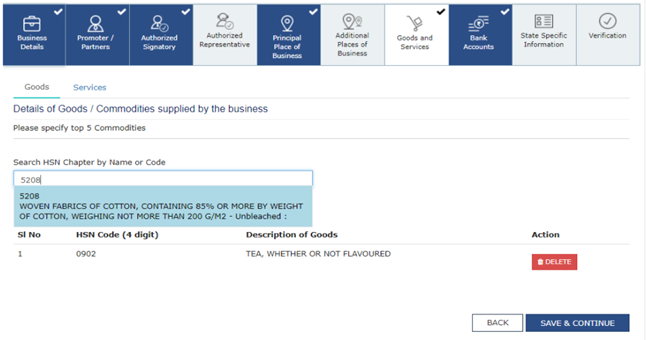

- BUSINESS INFORMATION

- In the Trade Name field, enter the trade name of the business.

- Input the Constitution of the Business from the drop-down list.

- Enter the District and Sector/ Circle / Ward / Charge/ Unit from the drop-down list.

- In the Commissionerate Code, Division Code and Range Code drop-down list, select the appropriate choice.

- opt for the Composition Scheme, if necessary

- Input the date of commencement of business.

- Select the Date on which liability to register arises.

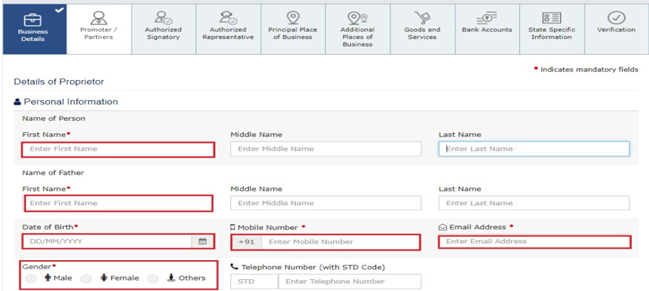

PROMOTER INFORMATION

The Following details must be submitted for the promoters:

- Personal details of the stake holder such as Name, DOB, Email id and etc.

- Designation of the Promoter.

- DIN (Director Identification Number) Of the Promoter, only for few mentioned below.

- Private Limited Company.

- Public Limited company.

- Public sector undertaking.

- Unlimited company.

- Foreign company Reg in India

- Details of Citizenship.

- PAN & AADHAR.

- Residential Address.

- In case the applicant provides Aadhar, the applicant can use Aadhar e-sign for filing GST returns instead of a digital signature.

- CLICK SAVE AND CONTINUE

- AUTHORISED SIGNATORY INFORMATION

He is nominated by the promoters of the company & should hold the responsibility of the filling GST returns of the company; and he will have the full access of the GST portal

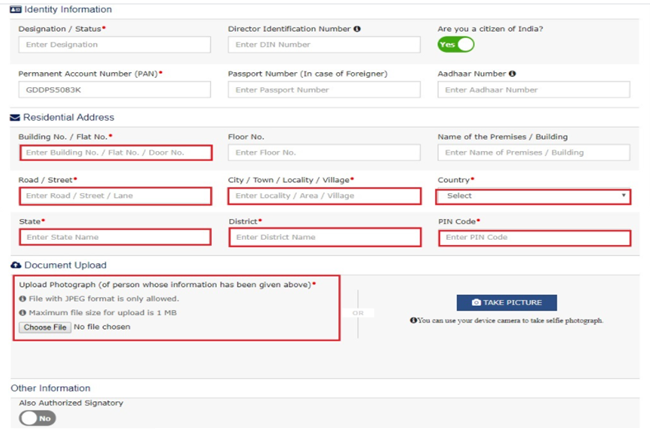

- PRINCIPAL PLACE OF BUSINESS

Please enter the following details:

- Address of the Principle lace of business.

- Official Contact Such as Email id, Telephone number etc.

- Nature of possession of the Premises.

If the principal place of business located in SEZ or the applicant acts as SEZ developer, necessary documents/certificates issued by Government of India are required to be uploaded by choosing ‘Others’ value in Nature of possession of premises drop-down and upload the document.

Please upload the documents here:

- ADDITIONAL PLACE OF BUSINESS

Upon having an additional place of business, enter details of the property in this tab; For instance, if the applicant is a seller on Flipkart or other e-commerce portal and uses the seller’s warehouse, that location can be added as an additional place of business

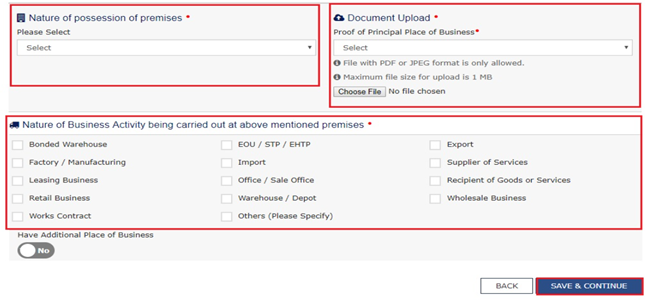

- DETAILS OF GOODS AND SERVICES

In this section, the taxpayer must provide details of the top 5 goods and services supplied by the applicant. For goods supplied, provide the HSN code and for services, provide SAC code.

HSN & SAC CODES WILL BE PROVIDED IN THE SEPARATE SHEET

BANK ACCOUNT DETAILS

Enter the number of bank accounts held by the applicant. If there are 5 accounts, enter 5. Then provide details of the bank account like account number, IFSC code and type of account. Finally, upload a copy of the bank statement or passbook in the place provided.

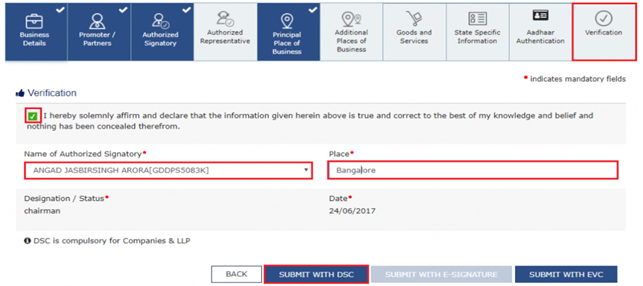

- VERIFICATION OF APPLICATION.

In this step, verify the details submitted in the application before submission. Once verification is complete, select the verification checkbox. In the Name of Authorized Signatory drop-down list, select the name of the authorized signatory. Enter the place where the form is filled. Finally, digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC. Digitally signing using DSC is mandatory in case of LLP and Companies.

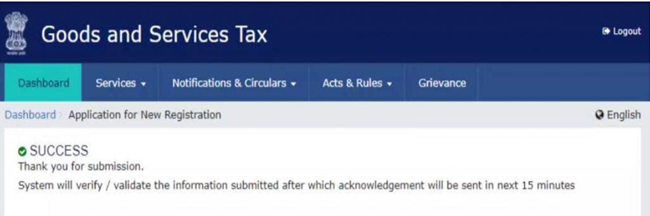

- ARN GENERATED

A message will be displayed on successful application, Application Reference Number(ARN) is sent to registered email and mobile.

On signing the application, the success message is displayed, The acknowledgment shall be received in the registered e-mail address and mobile phone number, Application Reference Number (ARN) receipt is sent to the e-mail address and mobile phone number, Using the GST ARN Number, the status of the application can be tracked.

Watch the full video on GST registration.: